- Original Article

- Open access

- Published:

The effects of the new statutory minimum wage in Germany: a first assessment of the evidence

Journal for Labour Market Research volume 53, Article number: 10 (2019)

Abstract

Germany did not establish a statutory minimum wage until 2015. The new wage floor was set at an initial level of €8.50 per hour. When it was introduced, about 11 percent of German employees earned less than that amount. Based on descriptive figures, qualitative research and difference-in-differences analyses, we provide an overview of the available evidence regarding some of the topics that have attracted the most attention in international research and policy debates: the effects on wages and the wage distribution including issues of compliance in relation to the implementation of the new minimum wage, on the risk of poverty, on employment and the impact on businesses for instance with respect to productivity, prices or profits. The evidence shows that the minimum wage has increased hourly wages significantly, while the effect on monthly salaries has been far less substantial, as companies have partly reduced contractually agreed-upon working hours. Besides reductions in working hours or increases in work intensity, companies highly affected by the introduction of the minimum wage have used price increases and have had to accept profit reductions as a response to the new wage floor. If studies found any employment effects, they were—whether positive or negative—rather small in relation to the overall number of jobs. As in other countries, the minimum wage has not helped to reduce welfare dependency and the risk of poverty. Non-compliance remains a challenge for the implementation of the new statutory minimum wage.

1 Introduction

The minimum wage is one of the most debated issues in labour market economics. Over the last few decades, there has been a vast amount of international empirical research on its effects (for reviews of this research, see, e.g., Belman and Wolfson 2014; Neumark and Wascher 2008). Prior to Card and Krueger’s (1994) seminal work on minimum wages in the fast food industry in New Jersey and Pennsylvania, there was a consensus among economists that a binding minimum wage set higher than the market-clearing competitive level would in general have adverse employment effects (Brown et al. 1982). Since then, the so-called new minimum wage research (Card and Krueger 1995) has challenged this view. While most studies have focused on employment effects and still continue to do so, recent research also highlights the importance of other adjustment channels, such as working hours, productivity, profits and prices (Metcalf 2008; Schmitt 2015; Hirsch et al. 2015; Low Pay Commission 2015).

Germany only established a general statutory minimum wage on January 1, 2015. It offers a rare, yet prominent example of a wage threshold being introduced nationwide in a large developed country. This article provides a comprehensive survey of the existing empirical evidence on the effects of what is regarded as the most important labour market reform in Germany since the Schröder government’s Agenda 2010 program in the early 2000s. It attempts to provide a rather non-technical access to the findings available so far (for a more technical economics perspective, see Caliendo et al. 2019) and goes beyond Bruttel et al. (2018), who could only present descriptive findings that were available at that time. Our article draws on a wide range of evidence from both descriptive statistics and causal impact analyses. The article focuses on those issues that have generally attracted the most attention of international researchers. We will cluster these topics into four areas: First, we present evidence on the effects on wages. In this context, we will also discuss compliance issues arising from the implementation of the new minimum wage. Second, we will discuss whether increases in wages have led to decreases in welfare dependency and risk of poverty. Third, we will turn to the effects on employment. Finally, we focus on the impact on businesses, including changes in working hours, consumer prices, productivity, profits and competition.

Set at an initial level of €8.50 per hour, the minimum wage directly affected the wages of around 4.0 million employees who earned less than €8.50 before the introduction of the minimum wage. This corresponds to about 11.3 percent of the dependent workforce—with significant regional differences. While in Western Germany 9.3 percent of employees had earned less than €8.50, this figure was 20.7 percent in Eastern Germany. Measured by the Kaitz index, which defines the relationship between the minimum and median wage, the new German minimum in 2015 (48 percent) was currently roughly equal to that of the UK (49 percent) and the Netherlands (46 percent). With respect to OECD countries, at the top, France had an index of 62 percent; at the bottom, Spain’s was 37 percent (OECD 2017). The minimum wage was increased twice since its introduction. By January 2017, it had increased to €8.84 per hour; by January 2019 to €9.19. By January 2020 there will be another increase, to €9.35.

The new statutory minimum wage covers all employees, with few exceptions (youths under 18 years of age, apprentices, certain categories of trainees and interns, the long-term unemployed in their first 6 months after starting a new job and non-profit and/or voluntary workers).Footnote 1 In addition, in a transition period that lasted until the end of 2017, wages below the statutory minimum wage were allowed in sectors with collectively agreed-upon minimum wages that are made generally binding by government decree. This applied to meat processing, hairdressing, agriculture, temporary agency work, textiles and clothing and industrial laundries (Mindestlohnkommission 2018, p. 167). The minimum wage for newspaper delivery staff was also set below the statutory level until the end of 2017. Approximately 195,000 employees in these sectors earned less than the statutory minimum wage in 2015 (Mindestlohnkommission 2018, p. 20). This corresponds to about 0.5 percent of the total workforce, or 5 percent of the 4.0 million employees who earned less than €8.50 per hour before the introduction of the minimum wage in 2015.

A number of sectors also have sector-specific minimum wages that are higher than the statutory minimum wage. The first sectoral minimum wages were introduced in the late 1990s and were made generally binding by government decrees. In June 2018, eleven sectors had sectoral minimum wages ranging from € 9.27 to € 16.53 per hour (Mindestlohnkommission 2018, p. 168). The workers that fall under the sectoral minimum wages cannot be numbered accurately as the scope of application is difficult to map in statistical data. With this limitation in mind, the available data suggests that the largest sector is the construction and subconstruction sector with around 1.9 million employees that work in these industries, many of course earning higher wages than the sectoral minimum wage, respectively. The next largest sectors are the commercial cleaning sector with around 1.1 million workers, the caring sector with around 900,000 workers, and temporary agency work with around 800,000 workers (Mindestlohnkommission 2018, p. 69).

2 Methods and data

Germany’s first experience with minimum wage evaluations dates back to 2011, when the Federal Ministry of Labour and Social Affairs commissioned the evaluation of eight of the sectoral minimum wages. Most of the studies used a difference-in-differences approach based on micro-level data (see this journal’s special issue in 2012, volume 45, number 3/4, including the overview by Möller 2012). While the majority of these studies found that sectoral minimum wages had significant positive effects on the wages of low-paid workers and showed only minimal or no job losses, for some sectors with very high minimum wages relative to median wages—for instance, in the roofing sector in Eastern Germany—researchers identified significant negative employment effects (Aretz et al. 2013). The current evaluation of the statutory minimum wage could thus build on these earlier experiences.

The difference-in-differences approach is the most common method for evaluating minimum wage effects. This approach identifies casual effects by comparing a treatment group that is affected by the introduction of the minimum wage to a non-affected control group. In the United States, which can be seen as the nucleus of modern minimum wage research, this has usually implied the comparison of neighbouring (in recent years, distant as well) but similar, states or counties, in which the minimum wage was increased in one and remained unchanged in the other. Since the minimum wage applies to almost all workers in Germany, this ideal-type approach cannot be applied. Following, in particular, research from the United Kingdom, whose introduction of a national minimum wage in 1999 faced similar methodical challenges, two modified difference-in-differences approaches have been used so far. First, a so-called incremental difference-in-differences approach was applied using the variation of minimum wage relevance across regions, sectors, companies or professions. This approach compares, for instance, regions with different bites (i.e., shares of workers), affected by the new minimum wage, holding other factors such as the region’s economic structure or purchasing power constant (see, e.g., Ahlfeldt et al. 2018; Bonin et al. 2018; Caliendo et al. 2018). In a similar vein, Bossler and Gerner (forthcoming) compare affected and non-affected companies based on the question of whether a company had workers with hourly wages below €8.50 before the introduction of the minimum wage. Holtemöller and Pohle (2017) use a variation of this approach. They estimate idiosyncratic employment trends in a structural break model and compare the observed outcomes from those derived from that model. The second principal approach compares employees who earned less than €8.50 per hour before the introduction of the minimum wage to employees earning slightly above €8.50 (see, e.g., Burauel et al. 2018; Bruckmeier and Becker 2018; Pusch and Rehm 2017).

Analyses of the German minimum wage can draw on a wide range of data sources (Mindestlohnkommission 2018; Caliendo et al. 2019). The first set of data comes from administrative sources such as the employment statistics of the Bundesagentur für Arbeit (German Federal Employment Agency). It covers all employment relationships and also includes periods of unemployment. On a regional level, it is easily and promptly accessible for aggregate groups, such as type of employment, gender or age, and has been the major source for studies focusing on employment effects. For scientific purposes, the Integrated Employment Biographies (IEB) of the Institut für Arbeitsmarkt- und Berufsforschung (IAB, Institute for Employment Research, the research unit of the Bundesagentur für Arbeit) constitute the central administrative data. The panel includes every person who was in dependent employment or received unemployment benefits at least once. It includes detailed data on salaries. While the data can be regarded as highly reliable, it has a major drawback in that it does not include working hours. It is thus hardly possible to calculate hourly wages even though some authors have imputed working time information from other data sources (see, e.g., Ahlfeldt et al. 2018).

The second set of data on wages and working time is survey data, coming from either employers or employees. Data from employers are reported in various representative employer surveys by the Statistisches Bundesamt (Federal Statistical Office, Destatis): the 2014 Verdienststrukturerhebung (VSE) (Structure of Earnings Survey) and the 2015, 2016 and 2017 Verdiensterhebung (VE) (Earnings Survey).Footnote 2 While the VSE 2014 is a mandatory survey covering about 60,000 companies and a total of around 1 million employment relationships, the VE 2015 to 2017 are voluntary surveys with rather low response rates of between 6 and 14 percent, respectively, and only cover between 6000 and 8000 companies and between 69,000 and 76,000 employment relationships. The major data sets offering an employee perspective are the German Socio-Economic Panel (SOEP), an annual representative panel survey of approximately 16,000 households, and the Panel Study “Labour Market and Social Security” (PASS), also an annual representative household panel with a sample of approximately 10,000 households. The PASS focuses on the situation of welfare benefit recipients and includes an over-sampling of this specific group. No direct information on hourly wages can be obtained from any of the surveys. Hourly wages need to be calculated using the available information on (weekly) working hours and (monthly) salaries. There are several challenges when calculating hourly wages (see Dütsch et al. 2018 for further details). Different wage components, such as extra payments, cannot be separated, for instance, and working hours and monthly wages do not necessarily refer to the same time period. The recall of actual working hours may also be biased.

Additional insights on establishment-level adjustments to the minimum wage come from further surveys undertaken by the IAB. The two most relevant of these surveys, also used in the Mindestlohnkommission (2018) report are the IAB Betriebspanel (IAB Establishment Panel), a representative annual panel survey of some 16,000 companies across all industries, and the IAB Stellenerhebung (IAB Job Vacancy Survey), a representative survey based of around 75,000 companies and public authorities.

3 Wages

There is a consenus among economists that minimum wages increase the wages of workers whose pay rates had previously been below the new wage threshold (Belman and Wolfson 2014). In many countries, the minimum wage led to the formation of a substantial wage bracket at and/or slightly above the minimum wage (see, e.g., for the United Kingdom Low Pay Commission 2011, 2017). There is less clear-cut evidence on the size of possible spillover effects—whether employees who had previously earned slightly above the minimum wage also experience wage increases (see, e.g., Belman and Wolfson 2014; Low Pay Commission 2015).

The German case broadly confirms this picture. The introduction of the statutory minimum wage in 2015 resulted in a significant increase of hourly wages at the bottom of the wage distribution scale. Based on SOEP data, hourly wages for employees who earned less than €8.50 in 2014 increased by roughly 14 percent on average between 2014 and 2016, while the average 2-year increase between 1998 and 2014 was only about 1 percent for this group (Burauel et al. 2018). Using a difference-in-differences approach, Burauel et al. (2018) show that this wage increase is indeed linked to the introduction of the minimum wage. Wage increases can be observed especially in groups that showed a high incidence of hourly wages below €8.50 per hour before the introduction of the statutory minimum wage. These groups include female employees, low-skilled workers, workers in smaller businesses and employees in marginal, part-time jobs (termed Minijobs in Germany). The latter is a specific form of employment, introduced in 2003, in which employees can earn €450 per month free of income tax and social security contributions, though they receive no health insurance and only optional pension insurance.

Above average increases could also be observed in low-wage sectors of which many are found in services. Table 1 shows the 20 industries with the highest shares of jobs paying lower than €8.50 (see also Mindestlohnkommission 2018). Based on these top 20 sectors with the highest incidence of jobs earning less than €8.50 per hour in 2014, according to VVE data wages in Eastern Germany increased by 7 percent in 2015 compared to an average total increase in Eastern Germany of 4 percent. Wage increases for less-skilled employees in these sectors were even higher. In 2015, workers without any vocational training experienced an increase of around 13 percent, while wages for low-skilled workers increased more than 9 percent.

These large increases seem to be mostly a one-time effect of raising wages to the new minimum level. In 2016 and 2017, wage increases in the aforementioned groups were more or less in line with overall wage development. This is not surprising, as the Minimum Wage Commission takes the development of collectively agreed wages as a guideline for their decisions on raising wages. Nevertheless, given that wages at the bottom end of the wage distribution were often below average in the years prior to 2015, the new minimum wage ensures that they at least keep up with overall wage increases in the future.

As regards monthly gross wages, the effects are considerably weaker or non-existent. Descriptive analyses based on VSE/VE data suggest an increase of approximately 4 percent over the period from 2014 to 2016, while difference-in-differences analyses show that even this increase is statistically insignificant (Mindestlohnkommission 2018). One possible explanation is that following the introduction of the statutory minimum wage, contractually agreed working hours were reduced in some cases, which completely or partially levelled the hourly wage effects (see below).

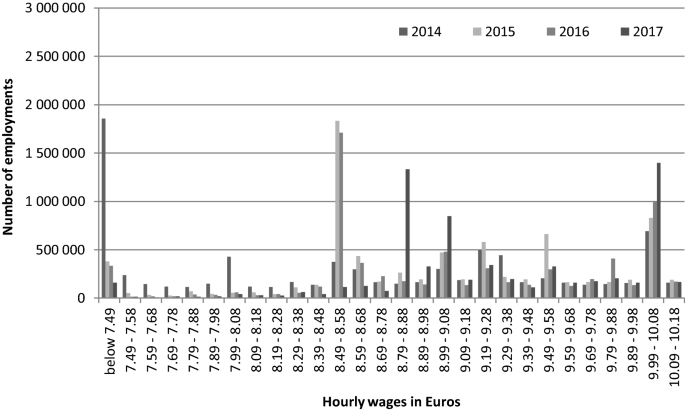

The compression of hourly wages at the lower part of the wage distribution, observable in other countries, is also visible in Germany, in particular in the employer-based VE data of the Federal Statistical Office (Fig. 1). In 2015 and 2016, when the statutory minimum wage was at €8.50, almost 2 million employees, most of whom earned less than €8.50 before that date, received exactly the minimum wage. In 2017, when the minimum wage had been raised to €8.84, this peak largely moved to the new threshold. The statutory minimum wage seems to influence collective agreements, too. While the situation may be different among industries, first case studies and quantitative evidence suggest that the collective wage differentials at the lower end of the wage distribution have diminished. Collective wages that have so far been slightly above the statutory minimum wage have been increased less or not at all compared to those that had to be adjusted to the new minimum wage level to comply with the new legislation (Lesch 2017; Statistisches Bundesamt 2017a).

Source: Destatis, Structure of Earnings Survey 2014, Earnings Surveys 2015, 2016 and 2017, own calculations. Note: Gross hourly wages without special or overtime payments. Population includes all individuals subject to the minimum wage

Number of jobs at the bottom of the wage distribution 2014 to 2017

The evidence regarding spillover effects is mixed. Descriptive analyses based on VSE/VE data show a positive effect up to a range of about €11 per hour, while the only study that uses a difference-in-differences approach based on SOEP data does not find any significant effects (Burauel et al. 2018). In the IAB Establishment Panel, roughly one in seven companies that had an employee earning less than €8.50 before the introduction of the minimum wage said that they also raised wages of employees that had already earned more than €8.50 prior to the new wage floor (Mindestlohnkommission 2016a). Companies’ considerations on intra-firm fairness, in particular with respect to wage differentials between employees with different levels of qualification, often drive the observed spillover effects (Koch et al. 2018; Grossman 1983). The significant wage increases for employees earning less than the minimum wage and accompanied spillover effects, however, did—according to VSE/VE as well as SOEP data—not reduce the size or the composition of the low-wage sector, which comprises employees earning less than two-thirds of the median wage, which in Germany corresponds to roughly €10 per hour (Bruttel et al. 2017; Kalina and Weinkopf 2017).

Even though there have been wage increases at the bottom end, it becomes evident from Fig. 1 that a significant number of employees do not earn the minimum wage. Based on the Federal Statistical Office’s VE data depicted in Fig. 1, about 750,000 jobs earned below the minimum wage in 2016. Based on SOEP data, the German Institute for Economic Research (DIW) even found around 1.8 million employees earning less than €8.50 per hour in 2016 in terms of contractually agreed working hours (Burauel et al. 2017).Footnote 3 Several caveats have to be considered when interpreting these figures. On the one hand, figures indicating wages below the statutory minimum wage do not automatically constitute actual violations of the Minimum Wage Act. On the other hand, possible violations might not be recorded by the surveys. Both data sources, VE and SOEP, have their limits and can lead to the specified numbers becoming larger or smaller (Mindestlohnkommission 2018; Dütsch et al. 2018). These concrete methodological limitations concern, for one, how the circle of eligible persons is specified. This includes, in particular, the recording of temporary exemptions from the statutory minimum wage for certain industries and the appropriate consideration of marginal part-time jobs (Minijobs). For another, the calculation of hourly wages based on weekly working hours and monthly earnings is a challenge. It concerns especially the question which wage components, such as certain types of allowances and overtime pay, can be counted as parts of the minimum wage as well as the registration of paid and unpaid hours of extra work. In addition, the companies surveyed in the VE may tend to avoid providing information that indicates non-compliance with the minimum wage. In the SOEP’s survey, there is always the possibility of employees providing inaccurate information, in particular regarding their working hours. Despite the methodological shortcomings of the VE and SOEP surveys, both databases find evidence for minimum wage implementation deficits.

The extent of non-compliance can also be judged from another perspective: the results obtained from monitoring and enforcement activities. In Germany, the FKS (Finanzkontrolle Schwarzarbeit, Financial Monitoring Unit for Illicit Employment), a special unit within the Generalzolldirektion (Customs Authority), is responsible for monitoring the minimum wage (for details see Mindestlohnkommission 2018). Its controls are part of employer inspections, which focus mainly on activities in the shadow economy. In 2017, the FKS screened 52,000 employers. The screened employers are selected through risk profiling, which means that controls were focused on employers which, based on characteristics such as company size, industry or past records, showed an above-average probability of violating the new minimum wage. In general, inspections are conducted through unannounced on-site visits. These inspections resulted in the opening of 5442 preliminary investigations on the violation of the Minimum Wage Act. In the same year, 3206 investigations resulted in fines. Even though the figures cannot be compared directly because investigations might not be closed in the same year as they were opened, they provide a rough idea about the size of successful investigations (for figures since 2015, see Mindestlohnkommission 2018, p. 71).

4 Welfare dependency and risk of poverty

Proponents of the minimum wage argued ahead of its introduction that it might help to reduce the number of people who, despite being employed, receive supplementary Unemployment Benefit II (‘Aufstocker’). However, their numbers decreased only marginally more than in the years prior to the introduction of the minimum wage. There are various reasons why the number of people falling into this group did not decrease more notably (Mindestlohnkommission 2018; Bruckmeier and Becker 2018). First, when the statutory minimum wage was introduced, its level was set to allow a full-time employed single person to earn enough to avoid Unemployment Benefit II. However, of the roughly 1.1 million employed persons receiving supplementary Unemployment Benefit II, only 3 percent are full-time employed single individuals. The vast majority lives in other household types. In particular, if households include non-working members, mostly children, a full-time job at the minimum wage level will not suffice to avoid welfare dependency for the household. Accordingly, the decline in the number of ‘Aufstocker’ in households composed of single people or couples without children is—on a very low level—stronger than for single parents and for couples with children after the introduction of the statutory minimum wage. A second reason, related to the first, is that welfare dependency tends to be linked to a low number of weekly working hours rather than to low hourly wages. Third, high rents, especially in urban areas, may result in neediness despite the minimum wage (Deutscher Bundestag 2018; Herzog-Stein et al. 2018).

The pattern of poverty risk is similar and illustrates the limits of the minimum wage as an instrument suitable for reducing the risk of poverty. A household is seen as being at risk of poverty if its available income is less than 60 percent of the median income of the total population, both equalized according to the new OECD scale (for details, see Bruckmeier and Becker 2018).Footnote 4 Indeed, poor households are often those without employment. In 2014, according to PASS data, only about 23 percent of all people at risk of poverty were actually employed and could therefore potentially benefit from higher wages. In addition, low wage earners do not necessarily live in households at risk of poverty. Only roughly 27 percent of employees earning less than €8.50 in 2014 lived in households at risk of poverty. The majority lived in households with a household income above the poverty line (Mindestlohnkommission 2018; Bruckmeier and Becker 2018).

The evidence is thus in line with international research, from the US in particular, that paints a rather sceptical picture of the potential of minimum wages to reduce welfare dependency and risk of poverty (see, e.g., OECD 2015 and Belman and Wolfson 2014, for further references). The German case supports the OECD’s (2015, p. 49) judgement that ‘minimum wages on their own are a relatively blunt instrument to reduce poverty’.

5 Employment effects

From a theoretical perspective, the employment effects of a minimum wage can be negative, positive or neutral. The standard neo-classical theory that has dominated views on minimum wages for many decades predicts employment losses in a perfectly competitive labour market if the minimum is set above the market-clearing wage, which should always be the case since current wage levels would be appropriate. Modifications to this standard model, such as the monopsony model, claim that labour markets are imperfect. Transaction costs, such as search, information or mobility costs, may allow employers to exploit their bargaining power and set wages below market-clearing rates. In such cases, labour market outcomes might be inefficient, resulting in lower wages and lower employment levels than in a competitive framework. Minimum wages would thus increase wages and employment levels and promote the efficiency of the labour market (Borjas 2015; Manning 2003). Coming from a completely different set of theoretical assumptions, Keynesian models argue that employment is not determined by the wage level but by the aggregate demand for goods and services. Against this background, minimum wages can help to increase incomes, thereby stimulating consumption, and also to make companies produce more goods and services and increase their demand for labour, and thus to increase employment (Herr et al. 2009; 2017).

Empirical evidence recently obtained from other countries suggests that economists have long overrated the employment effects of minimum wages. While some studies still find significant negative effects—mostly limited to specific labour market groups, such as teenagers or low-skilled workers—a consensus seems to have emerged among economists that, when set at an appropriate rate, minimum wages do not severely harm employment (Manning 2016, 2018; Dickens et al. 2015). This is supported by four extensive quantitative meta-studies with evidence from the United States and the United Kingdom, in particular (Doucouliagos and Stanley 2009; Belman and Wolfson 2014; de Linde Leonard et al. 2014; Hafner et al. 2017). The British Low Pay Commission states, based on 15 years of research, that the national minimum wage ‘has led to higher than average wage increases for the lowest paid, with little evidence of adverse effects on employment or the economy’ (Low Pay Commission 2015). In their older, but still frequently cited narrative survey, Neumark and Wascher (2008) conclude that the empirical evidence mainly supports negative employment effects. The overview provided by Neumark (2017) seems less clear-cut, however. Manning (2016, 2018) also emphasises that most of these negative effects are restricted to specific and often small labour market groups.

In Germany, the possible employment effects are also the topic which has drawn the most attention from academics and researchers. At least nine studies have been published to date that use a difference-in-differences approach (see Table 2). From a pure descriptive perspective, we find that overall employment has continued to develop positively since the introduction of the minimum wage in 2015. From April 2014 to April 2015, an additional 462,000 jobs were created, a rise of 1.4 percent. In 2016 and 2017, there was an increase of 1.9 and 1.8 percent, respectively. Beyond this positive overall trend, however, two types of employment with distinctive developments have to be differentiated. On the one hand, regular employment subject to social security contributions has continued to increase and is currently at an all-time high of more than 30 million (excluding apprenticeships and under-18-year-olds). On the other hand, the number of people working exclusively in marginal part-time employment (Minijobs) decreased noticeably in January 2015. There were 100,000 fewer people in these jobs in 2015 than at the beginning of 2014, and by April 2015 there were 153,000 less of these jobs in a year-to-year comparison (Mindestlohnkommission 2018). Roughly half of those employees moved into jobs that were subject to social security contributions. The other half withdrew from the labour market or registered as unemployed (see also vom Berge et al. 2016a).

The causal impact analyses provide a more differentiated picture (Ahlfeldt et al. 2018; Bonin et al. 2018; Bossler et al. 2018; Bossler and Gerner forthcoming; Caliendo et al. 2018; Garloff 2017; Holtemöller and Pohle 2017; Schmitz 2017; Stechert 2018). While all of the studies find that the introduction of the minimum wage has caused a reduction in the number of people who are marginally employed, confirming the findings from the descriptive analyses, the picture is mixed with respect to employment subject to social security contributions. Some studies have found negative effects, others positive, still others no significant effects. Either way, the effects are small compared to the total number of jobs liable to pay social security contributions. Negative effects always result from slower employment growth than there would have been without the minimum wage, that is, existing jobs subject to social security contributions were not cut back. With respect to overall employment (that is, the sum of jobs subject to social security contributions and marginal jobs), the majority of studies detect a slightly negative effect due to the introduction of the minimum wage and attribute that trend to the reduction of the number of marginal jobs.Footnote 5 A possible explanation for the small employment effects could be that many of the industries highly affected by the minimum wage, such as the restaurant and hotel industry, but also retail, indeed exhibit a monopsony-type labour market structure (Bachmann and Frings 2017).

6 Impact on businesses

While employment effects have long been on the agenda of minimum wage researchers, impacts on other parameters on the business level have only recently attracted more attention. Before the introduction of the minimum wage, according to IAB Establishment Panel data, about twelve percent of German companies employed at least one worker at less than €8.50 per hour—again, with significant differences among regions. In Eastern Germany, almost one in four companies had at least one employee earning less than €8.50, while in Western Germany it was less than 1 in 10. In the restaurant and catering industry, around one-third of all firms had at least one employee earning less than €8.50 in 2014, in the food and consumption industry, as well as in retail, about one in four companies were directly affected by the minimum wage. In the affected companies, on average, almost half of the staff earned less than €8.50 per hour (Bellmann et al. 2015). The labour costs in these companies, measured as total gross wages per employee, increased by 6.3 percent more than in companies that were not affected by the minimum wage (Bossler et al. 2018). This roughly corresponds, as can be expected, to the results of the individual-level analyses.

Increasing labour costs may be compensated-for by a range of measures. In surveys of businesses conducted immediately after the minimum wage took effect in 2015, employers listed reductions in working hours and, partially to go along with this, increased work intensity as well as increased prices as the two most important measures to compensate for the wage increases (Bellmann et al. 2016; Statistisches Bundesamt 2017b).

6.1 Working hours

The minimum wage raises the cost of each hour of work performed by a low-wage worker. Companies may therefore react to increased wages by reducing working hours and—sometimes simultaneously, in the case of a constant workload—by raising work intensity. A reduction in working hours might also be initiated by employees to hold their monthly income stable while working fewer hours. International evidence on this topic is mixed with some studies finding reductions in working hours and others finding no significant effects (see overviews in Belman and Wolfson 2014; Low Pay Commission 2015; Neumark and Wascher 2008; Schmitt 2015).

Based on the Federal Statistical Office’s VSE/VE data, paid working hours of employees who had earned less than €8.50 before the introduction of the statutory minimum wage decreased immediately and notably after the Minimum Wage Act took effect. Between 2014 and 2015, weekly paid hours decreased from an average of 39.8 h to 36.7 h for full-time employees, which corresponds to a decrease of about 7 percent. Relative changes for part-time employees and marginal employees were similar.Footnote 6 The effect was mainly concentrated in the first year, with no further major changes in 2016 or 2017. Employee-based data from the SOEP supports the evidence of decreased working hours, though only for contractually agreed weekly working hours. As far as hours actually worked are concerned, the answers given by employees in the SOEP showed little to no change from the prior situation. Using a difference-in-differences approach based on SOEP data, Bonin et al. (2018) concluded that the reduction of contractually agreed weekly working hours can be attributed to the minimum wage, while changes in actually worked hours were statistically insignificant. This development obviously requires more detailed analysis, in particular in conjuncture with compliance issues mentioned above and possible measurement errors.

The relevance of reductions in working hours is also supported by qualitative findings. In the Minimum Wage Commission’s 2016 consultation with stakeholders, the federal employer association of the hotel and restaurant industry, as well as that of hairdressers, highlighted the fact that some of their member firms had reduced their hours of operation. In particular, less-intensive hours with lower turnover were cut back (Mindestlohnkommission 2016b). The relevance of changes in working hours to compensate for increased wage costs was also highlighted by the qualitative study conducted by Koch et al. (2018) involving 131 guided interviews of employees, employers and work councils.

6.2 Consumer prices

Companies may try to pass on additional labour costs to customers in the form of higher prices for goods and services. International surveys by Belman and Wolfson (2014) and Lemos (2008) conclude that while minimum wages lead to pay rises in sectors that employ a higher share of employees who are covered by the minimum wage, the impact on aggregate price levels is negligible. The evidence for Germany confirms this picture. Some of the industries especially affected by the minimum wage have experienced above-average price increases without having notably affected the overall price index. While the overall price index increased by 0.3 percent in 2015 and 0.5 percent in 2016, the prices in some of the industries particularly affected by the minimum wage increased by up to twenty times as much during the same 2-year period (Table 3). Even though price increases in these industries might be traced back to the minimum wage, not all of the observed price increases can necessarily be attributed to the minimum wage; they may also be caused by industry-specific developments in the business environment.

6.3 Labour productivity

There are several channels through which minimum wages can affect productivity (Riley and Bondibene 2017; Metcalf 2008; Schmitt 2015). Companies, for their part, may raise the productivity of their workers by implementing organisational changes, offering training to improve efficiency, hiring more productive workers or moving towards more capital-intensive forms of production. Workers might also, on their own, make more effort in return for a higher wage—or make less effort if decreasing wage differentials demotivate those who earned relatively more before the introduction of a general minimum wage. Though there is a wide range of potential channels, according to IAB Establishment Panel data, productivity, defined as business volume per employee, did not change in either 2015 or 2016 (Bossler et al. 2018). Nor could changes in company-financed training be observed (Bossler et al. 2018). At the same time, Koch et al. (2018), in their qualitative study, discovered a multitude of measures by which companies tried to increase their internal efficiency, including, in particular, improving internal business processes. But employers conceded that while the minimum wage triggered these actions, it was not the actual reason behind these adjustments. On the level of individual employees, quantitative studies show that employees who benefitted from the introduction of the minimum wage reported a slight increase in their subjectively perceived job satisfaction, while work effort has not increased significantly (Bossler and Broszeit 2016; Pusch and Rehm 2017). At the same time, the requirements and workload of these groups seem to have increased (Pusch and Rehm 2017; Koch et al. 2018). With respect to the hiring practices of companies, according to the IAB Job Vacancy Survey, employers seem to have increased their qualification and proficiency requirements for the engagement of new personnel who are paid minimum wages (Gürtzgen et al. 2016).

6.4 Company profits

In a mirror image of increased labour costs and constant productivity, profits in companies affected by the minimum wage have decreased. From 2014 to 2015, their profits, defined as the difference between business volume and the main cost components of advance performance as well as labour costs (measured as total gross wages) dropped by nine percentage points according to IAB Establishment Panel data compared to companies not affected by the minimum wage. This decrease can be statistically explained by increased labour costs as a result of the minimum wage (Bossler et al. 2018). On the macroeconomic scale, though, the development of company profits has been positive since 2014, with an average increase of between 2.8 and 3.7 percent per year (Mindestlohnkommission 2018). Thus far, both company dynamics and competition intensity have not shown noteworthy signs of change on the level of the economy as a whole or in the industries particularly affected by the minimum wage. Neither did market exits in the form of businesses deregistering or insolvency cases increase nor did the number of business registrations (Mindestlohnkommission 2018).

7 Conclusions

When looked at from a theoretical perspective, the effects of the minimum wage are ambiguous. Depending on the chosen model or model assumptions, minimum wages may have negative, positive or neutral effects on employment, but also other economic indicators such as consumption, investments or poverty risk. This article has provided a survey of the evidence for Germany, where a statutory minimum wage was introduced for the first time in 2015. Set at a level of €8.50 per hour, it covered approximately 4.0 million employees, which corresponds to roughly 11.3 percent of all employees.

The available data and research suggest that the new wage threshold has led to a significant increase in the hourly wages for those who earned less than €8.50 per hour prior to the introduction of the minimum wage. However, this increase in hourly wages does not fully translate to an increase in monthly salaries, as the available evidence suggests that working hours have been reduced at the same time. Even when studies found any employment effects—whether positive or negative—their size has been negligible in relation to the overall number of jobs. As in other countries, the minimum wage has not helped to reduce welfare dependency and the risk of poverty. While there have been no measurable effects on a macroeconomic level, companies that had to increase wages because they paid some of their employees less than the minimum wage before 2015 did see their profits diminish. On the level of the economy as a whole or in the industries particularly affected by the minimum wage, neither market exits in the form of businesses deregistering or insolvency cases nor the number of business registrations changed significantly. Some industries with a high share of minimum wage workers saw price increases, however, without a measurable impact on the overall price index. While productivity at the establishment level has not showed any changes, some authors reported an increase in job and wage satisfaction for minimum wage earners while at the same time measuring increased work intensity for this group. For the 2 to 3 years since the introduction of the minimum wage for which data and research results are available, both descriptive and causal analyses suggest that the effects of the statutory minimum wage have mainly been concentrated in the period immediately following its introduction and less in the years 2016 and 2017.

Compliance with the new minimum wage seems to be a major issue. Implementation deficits were observable even one and a half years after its introduction. Depending on the database used, either 750,000 or 1.8 million employees earned less than €8.50 per hour (with cautions regarding measurement issues for both figures). Ensuring a higher level of compliance will be a key challenge for the future. This might also include a discussion of effective instruments to ensure better compliance, a topic for which international exchanges may be of particular interest (ILO 2017; Benassi 2011).

This article has provided a review of the economic effects of the new statutory minimum wage in the first 3 years after its introduction in Germany. Although the evidence presented is based on robust, state-of-the-art methods, one has to keep in mind at least three caveats. First, the overall economic climate was favourable when the minimum wage was introduced and when it was raised for the first time. This does not imply that effects necessarily need to be very different during an economic downturn (Dolton and Bondibene 2012). Second, at this point in time, long-term effects such as automation (see, e.g., Lordan and Neumark 2018 for the United States) cannot yet be analysed. And third, the lack of full compliance as suggested by the available empirical data means that all studies are limited to detecting effects resulting from the actual implementation degree, but do not show effects that would result if the minimum wage was implemented completely and in full compliance with the law. Thus, minimum wage research will continue to be of importance in the future and will still need to address a wide range of open research questions, in particular regarding adjustment channels beyond employment and a better understanding of the challenges to ensuring compliance with minimum wages.

Availability of data and materials

Data sharing is not applicable to this article as no datasets were generated or analysed during the current study.

Notes

The exemption for the long-term unemployed has been evaluated by vom Berge et al. (2016b). They found that only 1.4 percent of the long-term unemployed have demanded the written confirmation necessary to make use of this possibility. This corresponds to around 350 confirmations per month. The number of confirmations that have actually been used is likely to be even smaller. According to vom Berge et al. (2016b), one reason for the low take-up was that the exemption is not actively promoted within the Job Centers that take care of the long-term unemployed. Job counsellors consider other instruments, such as wage subsidies, to be more promising than the exemption rule that is also associated with bureaucratic requirements.

In addition, the Federal Statistical Office provides data from the Vierteljährliche Verdiensterhebung (VVE) (Quarterly Earnings Survey). The survey offers highly comparable longitudinal data on earnings and working time collected from roughly 40,000 companies. However, the data is only available on an aggregate level and is thus not usable for micro-econometric evaluations. In addition, the VVE only covers companies with more than 10 employees (more than 5 in some sectors).

For the year 2017, after the minimum wage was raised to € 8.84 per hour, data on jobs with hourly wages below this new minimum wage threshold are only available through the VE database. For April 2017, the VE shows 830,000 jobs with remuneration below the new minimum wage and 500,000 jobs earning less than €8.50 an hour.

This equivalence scale takes into account that the needs of a household grow with each additional member but not in a proportional way, as there are economies of scale, for instance, regarding housing size or domestic appliances.

The available studies do not distinguish between full-time and part-time work, even though one might assume different effects as part-time work may have benefited from the transformation of marginal jobs to jobs subject to social security. The main reason why studies have not distinguished between full-time and part-time work may be that the publicly available aggregate data from the Federal Employment Agency, which has been used most often for the evaluation of employment effects, does offer this distinction. The Integrated Employment Biographies (IEB) as individual-level dataset does not offer this distinction but is only available with a significant time lag. In addition, the definition of “full time” and “part time” is somewhat blurred as it depends on the judgment of the individual companies. The imputation of working hours from other data might help (see, e.g., Ahlfeldt et al. 2018) but itself suffers from the typical drawbacks associated with such a procedure.

Regarding part-time employees and marginal employees, cross-section effects might be blurred by compositional effects. If the longest working marginal employees move into part-time jobs, they will then tend to be the shortest working hours among the covered part-timers. As a result, average working hours in both groups would decline in the cross section.

References

Ahlfeldt, G.M., Roth, D., Seidel, T.: The regional effects of Germany´s national minimum wage. Econ. Lett. 172(11), 127–130 (2018)

Aretz, B., Arntz, M., Gregory, T.: The minimum wage affects them all: evidence on employment spillovers in the roofing sector. Ger. Econ. Rev. 14(3), 282–315 (2013)

Bachmann, R., Frings, H.: Monopsonistic competition, low-wage labour markets, and minimum wages—an empirical analysis. Appl. Econ. 49(51), 5268–5286 (2017)

Bellmann, L., Bossler, M., Gerner, H.-D., Hübler, O.: Reichweite des Mindestlohns in deutschen Betrieben. IAB-Kurzbericht 6/2015 (2015)

Bellmann, L., Bossler, M., Dütsch, M., Gerner, H.-D., Ohlert, C.: Folgen des Mindestlohns in Deutschland. Betriebe reagieren nur selten mit Entlassungen. IAB-Kurzbericht 18/2016 (2016)

Belman, D., Wolfson, P.J.: What does the minimum wage do?. W. E. Upjohn Institute for Employment Research, Kalamazoo (2014)

Benassi, C.: The implementation of minimum wage: Challenges and creative solutions. Global Labour University Working Paper 12 (2011)

Bonin, H., Isphording, I., Krause, A., Lichter, A., Pestel, N., Rinne, U., Caliendo, M., Obst, C., Preuss, M., Schröder, C., Grabka, M.G.: Auswirkungen des gesetzlichen Mindestlohns auf Beschäftigung. Arbeitszeit und Arbeitslosigkeit, Studie im Auftrag der Mindestlohnkommission (2018)

Borjas, G.J.: Labor economics. McGraw-Hill Education, New York (2015)

Bossler, M., Broszeit, S.: Do minimum wages increase job satisfaction? Micro data evidence from the new German minimum wage. Labour 31(4), 480–493 (2016)

Bossler, M., Gerner, H.-D.: Employment effects of the new German minimum wage. Evidence from establishment-level micro data. Ind Labor Relat Rev (forthcoming)

Bossler, M., Gürtzgen, N., Lochner, B., Betzl, U., Feist, L., Wegmann, J.: Auswirkungen des gesetzlichen Mindestlohns auf Betriebe und Unternehmen. Studie im Auftrag der Mindestlohnkommission (2018)

Brown, C., Gilroy, C., Kohen, A.: The effect of the minimum wage on employment and unemployment. J. Econ. Lit. 20(2), 487–528 (1982)

Bruckmeier, K., Becker, S.: Auswirkung des Mindestlohns auf die Armutsgefährdung und die Lage von erwerbstätigen Arbeitslosengeld II-Bezieherinnen und -Beziehern. Studie im Auftrag der Mindestlohnkommission (2018)

Bruttel, O., Baumann, A., Himmelreicher, R.: Der gesetzliche Mindestlohn in Deutschland: Struktur, Verbreitung und Auswirkungen auf die Beschäftigung. WSI-Mitteilungen 70(7), 473–481 (2017)

Bruttel, O., Baumann, A., Dütsch, M.: The new German statutory minimum wage in comparative perspective: employment effects and other adjustment channels. Eur. J. Ind. Relat. 24(2), 145–162 (2018)

Burauel, P., Caliendo, M., Fedorets, A., Grabka, M.M., Schröder, C., Schupp, J., Wittbrodt, L.: Minimum wage not yet for everyone: on the compensation of eligible workers before and after the minimum wage reform from the perspective of employees. DIW Econ. Bull. 7(49), 509–522 (2017)

Burauel, P., Grabka, M.M., Schröder, C., Caliendo, M., Obst, C., Preuss, M.: Auswirkungen des gesetzlichen Mindestlohns auf die Lohnstruktur. Studie im Auftrag der Mindestlohnkommission (2018)

Caliendo, M., Fedorets, A., Preuss, M., Schröder, C., Wittbrodt, L.: The short-run employment effects of the German minimum wage reform. Labour Econ. 53, 46–62 (2018)

Caliendo, M., Schröder, C., Wittbrodt, L.: The causal effects of the minimum wage introduction in Germany: An overview. Ger. Econ. Rev. (2019). https://doi.org/10.1111/geer.12191

Card, D., Krueger, A.B.: Minimum wages and employment: a case study of the fast-food industry in New Jersey and Pennsylvania. Am. Econ. Rev. 84(4), 772–793 (1994)

Card, D., Krueger, A.B.: Myth and measurement. The new economics of the minimum wage. Princeton University Press, Princeton (1995)

de Linde Leonard, M., Stanley, T.D., Doucouliagos, H.: Does the UK minimum wage reduce employment? A meta-regression analysis. Br. J. Ind. Relat. 52(3), 499–520 (2014)

Deutscher Bundestag: Antwort der Bundesregierung auf die Kleine Anfrage der Fraktion Die Linke. Erforderliche Höhe des gesetzlichen Mindestlohns zur Armutsbekämpfung. Bundestagsdrucksache 19/3415 (2018)

Dickens, R., Riley, R., Wilkinson, D.: A re-examination of the impact of the UK national minimum wage on employment. Economica 82(328), 841–864 (2015)

Dolton, P., Bondibene, C.R.: The international experience of minimum wages in an economic downturn. Econ. Policy 27(69), 99–142 (2012)

Doucouliagos, H., Stanley, T.D.: Publication selection bias in minimum-wage research? A meta-regression analysis. Br. J. Ind. Relat. 47(2), 406–428 (2009)

Dütsch, M., Himmelreicher, R., Ohlert, C.: Calculating gross hourly wages—the (structure of) earnings survey and the German socio-economic panel in comparison. J. Econ. Stat. 1, 1 (2018). https://doi.org/10.1515/jbnst-2017-0121

Garloff, A.: Side effects of the introduction of the German minimum wage on employment and unemployment: Evidence from regional data—update. Bundesministerium für Wirtschaft und Energie Diskussionspapier 4 (2017)

Grossman, J.B.: The impact of the minimum wage on other wages. J. Hum. Resour. 18(3), 359–378 (1983)

Gürtzgen, N., Kubis, A., Rebien, M., Weber, E.: Neueinstellungen auf Mindestlohnniveau. Anforderungen und Besetzungsschwierigkeiten gestiegen. IAB-Kurzbericht 12/2016 (2016)

Hafner, M., Taylor, J., Pankowska, P., Stepanek, M., Nataraj, S., van Stolk, C.: The impact of the national minimum wage on employment: a meta-analysis. RAND Corporation (2017)

Herr, H., Kazandziska, M., Mahnkopf-Praprotnik, S.: The theoretical debate about minimum wages. Global Labour University Working Paper 6 (2009)

Herr, H., Herzog-Stein, A., Kromphardt, J., Logeay, C., Nüß, P., Pusch, T., Schulten, T., Watt, A., Zwiener, R.: Makroökonomische Folgen des gesetzlichen Mindestlohns aus keynesianisch geprägter Perspektive. Studie im Auftrag der Mindestlohnkommission (2017)

Herzog-Stein, A., Lübker, M., Pusch, T., Schulten, T., Watt, A.: Der Mindestlohn: Bisherige Auswirkungen und zukünftige Anpassung. Gemeinsame Stellungnahme von IMK und WSI anlässlich der schriftlichen Anhörung der Mindestlohnkommission. WSI Policy Brief 04/2018 (2018)

Hirsch, B.T., Kaufman, B.E., Zelenska, T.: Minimum wage channels of adjustment. Ind. Relat. 54(2), 199–239 (2015)

Holtemöller, O.; Pohle, F.: Employment effects of introducing a minimum wage: the case of Germany. IWH Discussion Paper 28/2017 (2017)

ILO: Minimum wage policy guide. International Labour Organization, Geneva (2017)

Kalina, T., Weinkopf, C.: Niedriglohnbeschäftigung 2015—bislang kein Rückgang im Zuge der Mindestlohneinführung. IAQ-Report 2017-06 (2017)

Koch, A., Kirchmann, A., Reiner, M., Scheu, T., Boockmann, B., Bonin, H.: Verhaltensmuster von Betrieben und Beschäftigten im Zuge der Einführung des gesetzlichen Mindestlohns. Studie im Auftrag der Mindestlohnkommission (2018)

Lemos, S.: A survey of the effects of the minimum wage on prices. J. Econ. Surv. 22(1), 187–212 (2008)

Lesch, H.: Mindestlohn und Tarifgeschehen: Die Sicht der Arbeitgeber in betroffenen Branchen. IW-Report 13/2017 (2017)

Lordan, G., Neumark, D.: People versus machines: The impact of minimum wages on automatable jobs. IZA Discussion Paper 11297(2018)

Low Pay Commission: National Minimum Wage. Low Pay Commission Report 2011. London (2011)

Low Pay Commission: National Minimum Wage. Low Pay Commission Report 2015. London (2015)

Low Pay Commission: National Minimum Wage. Low Pay Commission Report 2017. London (2017)

Manning, A.: Monopsy in motion. Imperfect competition in labor markets. Princeton University Press, Princeton (2003)

Manning, A.: The elusive employment effect of the minimum wage. Centre for Economic Performance Discussion Paper 1428 (2016)

Manning, A.: The truth about the minimum wage. Foreign Aff 97(1), 126–134 (2018)

Metcalf, D.: Why has the British national minimum wage had little or no impact on employment? J. Ind. Relat. 50(3), 489–512 (2008)

Mindestlohnkommission: Erster Bericht zu den Auswirkungen des gesetzlichen Mindestlohns. Bericht der Mindestlohnkommission an die Bundesregierung nach § 9 Abs. 4 Mindestlohngesetz (2016a)

Mindestlohnkommission (ed.): Stellungnahmen aus der schriftlichen Anhörung. Ergänzungsband zum ersten Bericht der Mindestlohnkommission (2016b)

Mindestlohnkommission: Zweiter Bericht zu den Auswirkungen des gesetzlichen Mindestlohns. Bericht der Mindestlohnkommission an die Bundesregierung nach § 9 Abs. 4 Mindestlohngesetz (2018)

Möller, J.: Minimum wages in German industries—what does the evidence tell us so far? J. Labour Market Res. 45(3/4), 187–199 (2012)

Neumark, D.: The employment effects of minimum wages: Some questions we need to answer. NBER Working Paper 23584 (2017)

Neumark, D., Wascher, W.: Minimum wages. MIT Press, Cambrigde (2008)

OECD: Employment Outlook 2015, Paris (2015)

OECD: Minimum wage database. https://stats.oecd.org/Index.aspx?DataSetCode=MIN2AVE (2017). Accessed 12 June 2018

Pusch, T., Rehm, M.: Mindestlohn, Arbeitsqualität und Arbeitszufriedenheit. WSI-Mitteilungen 70(7), 491–498 (2017)

Riley, R., Bondibene, C.R.: Raising the standard: minimum wages and firm productivity. Labour Econ. 44, 27–50 (2017)

Schmitt, J.: Explaining the small employment effects of the minimum wage in the United States. Ind. Relat. 54(4), 547–581 (2015)

Schmitz, S.: The effects of Germany’s new minimum wage on employment and welfare dependency. Free University Berlin School of Business & Economics Discussion Paper 2017/21 (2017)

Statistisches Bundesamt: Mindestlohn verringert Spannweite der Tarifverdienste in einzelnen Branchen, Press Release 16 August 2017 (2017a)

Statistisches Bundesamt: Verdiensterhebung 2015. Abschlussbericht einer Erhebung über die Wirkung des gesetzlichen Mindestlohns auf die Verdienste und Arbeitszeiten der abhängig Beschäftigten (2017b)

Stechert, M.: Eine kritische Analyse ausgewählter Effekte unter der Einführung des gesetzlichen Mindestlohns in Deutschland. Wirtsch Stat 2018(3), 40–53 (2018)

vom Berge, P., Kaimer, S., Copestake, S., Eberle, J., Klosterhuber, W., Krüger, J., Trenkle, S., Zakrocki, V.: Arbeitsmarktspiegel. Entwicklungen nach Einführung des Mindestlohns (Ausgabe 1). IAB-Forschungsbericht 1/2016 (2016a)

vom Berge, P., Klingert, I., Becker, S., Lenhart, J., Trenkle S., Umkehrer. M.: Mindestlohnbegleitforschung. Überprüfung der Ausnahmeregelung für Langzeitarbeitslose. IAB-Forschungsbericht 8/2016 (2016b)

Acknowledgements

We are grateful to the editor and the two anonymous reviewers for their helpful comments. The views expressed in this paper are those of the author and do not necessarily represent those of the Minimum Wage Commission.

Funding

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Contributions

The author read and approved the final manuscript.

Authors’ information

The author is head of the Geschäfts- und Informationsstelle für den Mindestlohn, the German Minimum Wage Commission’s Secretariat. The views expressed in this paper are those of the author and do not necessarily represent those of the Minimum Wage Commission.

Corresponding author

Ethics declarations

Competing interests

The author declares no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Bruttel, O. The effects of the new statutory minimum wage in Germany: a first assessment of the evidence. J Labour Market Res 53, 10 (2019). https://doi.org/10.1186/s12651-019-0258-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s12651-019-0258-z